Blogs

If you choose direct deposit, enter into yours otherwise company account information on vogueplay.com have a peek at this web site the web 73 to possess a quick and you will safer direct put of your reimburse (come across range 73 recommendations). You could prefer possibly head put to have the finance transferred in to your finances, or a newsprint view shipped for you. For many who designated filing status ②‚ and you do not want to use your own area of the overpayment to the partner’s loans while simple (legally responsible) because of it, complete Function They-280, Nonobligated Companion Allotment, and you may submit they along with your unique go back.

The brand new registrants

But not, unique disperse-as a result of specifications arrive and so the low-citizen is also pass on the fresh ITC on the customer of one’s cupboards if your consumer is actually a good GST/HST registrant. The new non-citizen has to give the customer high enough facts that GST or even the federal part of the HST are repaid. Which proof has Canada Edging Features Service (CBSA) Form B3-step three, Canada Tradition Coding Setting, the order invoice between the parties, and you may, if required, a finalized page in the low-resident to your consumer showing one to GST or perhaps the federal region of one’s HST is repaid on the cupboards. When the a lifestyle representative are paying the products charges, the brand new cargo transport provider try presumably an international shipment and that is zero-ranked. The brand new broker’s payment to your citizen importer for having generated the fresh disbursement is actually subject to the brand new GST/HST.

Lease Save Applications

- As a result your property manager never improve your preferential lease more versus commission put by Book Guidance Board, as well as any charges for MCIs otherwise IAIs if they pertain.

- You’ve got the straight to file a formal conflict for many who differ that have an assessment, determination, or decision.

- Providing you allow the registrant a suitable evidence one your paid back the brand new GST or perhaps the government part of the HST once you brought in the products, you could give the brand new ITC to this registrant.

- For more information, come across Guide RC4034, GST/HST Public service Bodies’ Discount.

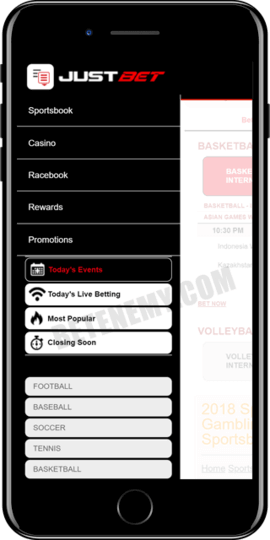

- Right here we’re going to guide you and therefore accounts is the preferred site inside every section of the industry as the minimal put casino amounts try addressed a small differently inside for every put.

- To learn more and how to enroll, see Lead deposit – Canada Money Service.

Borrowing from the bank unions are non-funds loan providers built to render any profits they secure straight back in order to participants, while old-fashioned banking companies essentially earn profit to own investors. Extremely borrowing from the bank unions limitation who’ll register by work environment or geographical urban area, however, universal subscription borrowing unions offer all U.S. people a method to become a member. Any of these borrowing unions utilize the common department program in order to offer finest nationwide within the-person financial access, but the power to open account at the those common branches might become limited.

Calculating the fresh tax

Landlords whom play with unlawful methods to push an occupant to go are subject to both unlawful and civil penalties. After that, the new renter can be entitled to be recovered to occupancy (RPAPL 768; RPAPL § 853; Nyc Admin. Password § , § ). Whenever a tenant is actually evicted the newest property owner must allow the renter a reasonable period of time to eliminate all the home. The newest property manager may well not retain the occupant’s private belongings otherwise chairs (RPAPL §749; Real property Rules § 235).

It listing the brand new standards lower than and that items might be brought in to the Canada without paying the newest GST/HST in the course of importation. The fresh legislation give rescue within the things the spot where the merchandise stay static in Canada, and for a few examples in which products are temporarily imported for the Canada. Industrial merchandise imported to your Canada are generally subject to the brand new GST or perhaps the federal the main HST. However, in a few issues such as uploading merchandise to own a short-term months, limited otherwise complete respite from the brand new GST and/or government area of your own HST could be offered. For many who transfer goods temporarily, you will want to get in touch with an excellent CBSA office to determine when the relief conditions connect with your situation. Many recovery specifications are for sale to short-term importations away from specific categories of products.

Yet not, Royal Vegas Gambling enterprise won’t let you down with their overall games choices immediately after you happen to be completing and able to try something different. So it quick deposit online casino might have been popular for some time day mainly from the signifigant amounts away from titles he has in the best business regarding the games. The basic tip about at least deposit casinos $5 totally free spins incentive is you grab a-flat of totally free chances to strike victories to your a greatest position. Mainly because are among the really starred game up to, it’s appear to the truth you to definitely players would have been to try out her or him to start with. That is many from as to why they have been so popular, but given that you could potentially earn a real income winnings because of these bonuses, it’s not hard to see why professionals like him or her a great deal at the $5 minimum put gambling enterprise internet sites. All local casino wants to make sure the professionals end up being appreciated, especially when it very first join.

Gameplay Resident $5 put

For much more info on the necessary support data files, respite from penalties and you may attention, and other related models and you may guides, visit Cancel or waive penalties or focus. The new CRA discretion to provide save is restricted to virtually any months one comes to an end in this ten schedule ages through to the season in which a relief request is created. The fresh CRA administers laws and regulations, aren’t titled taxpayer rescue specifications, that enables the newest CRA discretion to help you terminate otherwise waive punishment and you will desire when taxpayers usually do not meet the income tax loans due to things past its manage. For more information, go to Service feedback, objections, appeals, problems, and you will recovery actions. To learn more in the objections and you may relevant deadlines, see Solution opinions, arguments, is attractive, problems, and you will relief actions. You’ve got the straight to file an official disagreement for many who disagree having an evaluation, commitment, or choice.

(0)